Remember chasing the longest 0% APR for balance transfers? Dead. That strategy leads to costly mistakes. According to NerdWallet, focusing solely on intro APR obscures vital factors like fees and long-term card value. Here’s what truly matters for optimizing your balance transfer card selection.

The data is clear: blindly pursuing the longest introductory APR isn’t smart. I’ve analyzed many offers; people overlook fine print. A 0% offer gets negated by high transfer fees. Effective optimizing balance transfer card selection demands a deeper look.

The Real Story Behind the 0% APR Obsession

What media won’t tell: banks aren’t just giving free money. They rely on people only seeing the 0% offer, ignoring overall cost. This hinders effective optimizing balance transfer card selection. Old approaches are dead when you consider subtle costs.

What Media Won-t Tell You

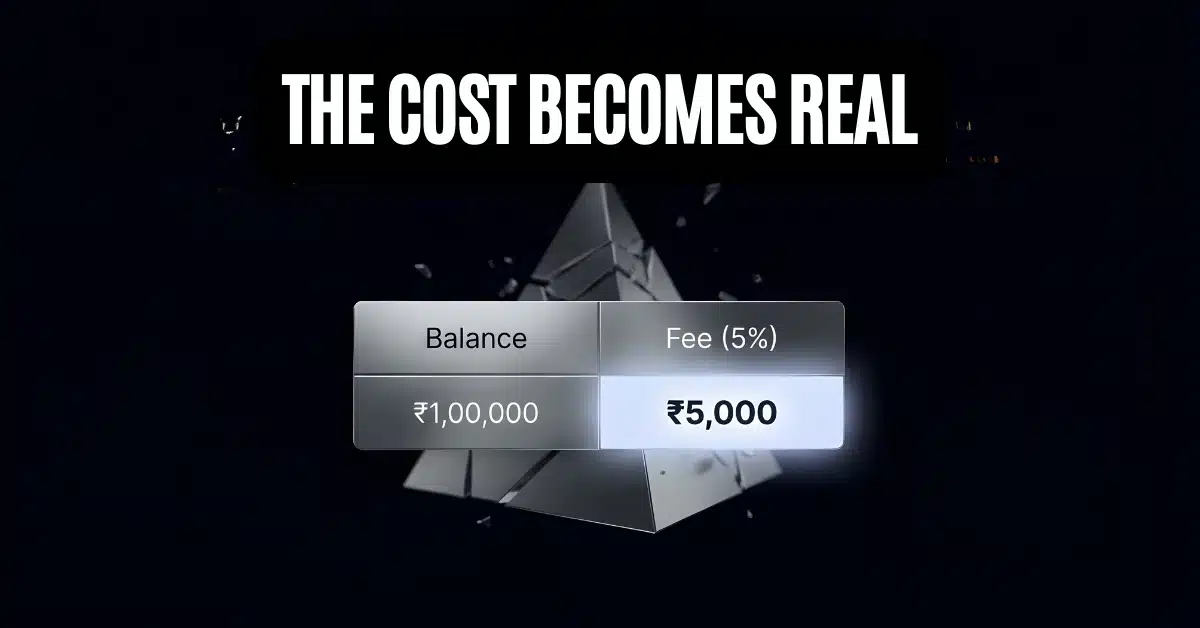

Most articles push the “longest 0% APR” without digging deeper. They ignore balance transfer fees, typically 3% to 5% of the amount. A 5% fee on ₹1,00,000 costs ₹5,000 upfront. That’s a brutal truth often missed discussing optimizing balance transfer card selection.

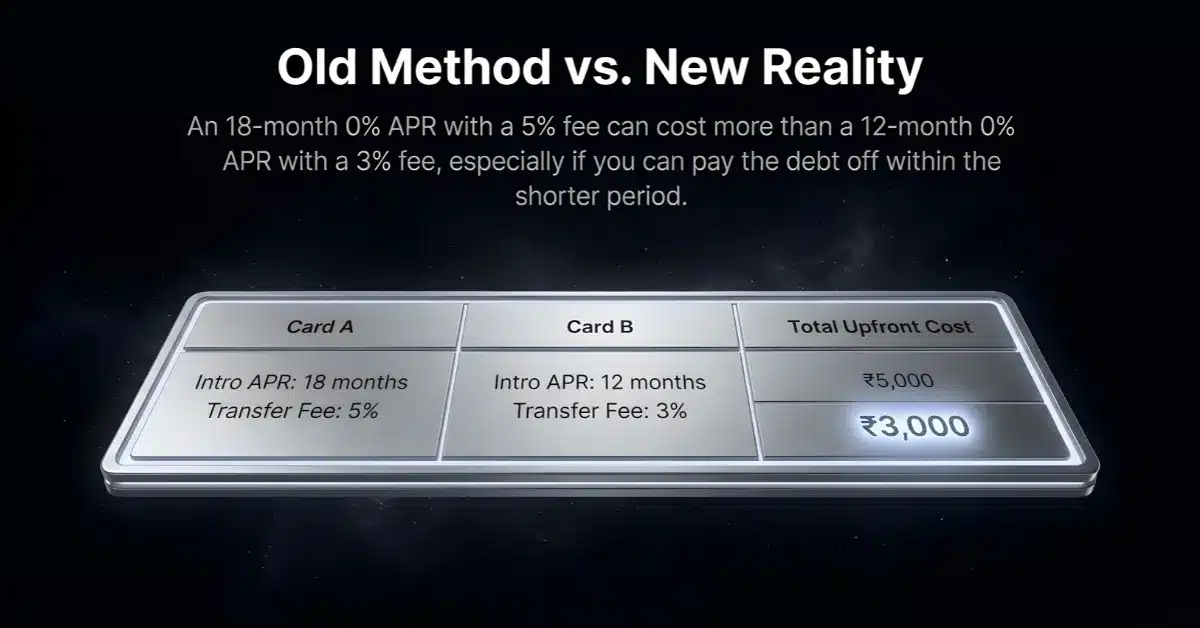

I’ve seen clients pay more in hidden fees than they save. This makes optimizing balance transfer card selection paramount. A shorter 0% period with lower or no fee is more beneficial if you pay off the balance quickly. Focus on total debt cost for a smarter optimizing balance transfer card selection approach.

What This Means for Your Balance Transfer Strategy

This changes the game: effective balance transfer isn’t just about avoiding interest for months. It’s about achieving your debt-free goal efficiently. For comprehensive optimizing balance transfer card selection, the smart move involves a holistic view of the card’s full terms.

The Smart Move Right Now

The smart move is to prioritize cards with lower balance transfer fees, even if the 0% APR period is slightly shorter. I always advise calculating total cost, including all potential fees. This allows for genuine and informed optimizing balance transfer card selection.

Another crucial factor is the post-introductory APR. Many cards jump to a very high rate once the 0% period ends. I’ve seen people inadvertently trapped, facing exorbitant interest charges. Consider long-term value and sustained affordability when optimizing balance transfer card selection. Will you adapt to this smarter approach, or watch your debt linger as others optimize their finances?

1000 + Free AI Agents